White Paper: NCU: The Commons’ Denominator: The “missing link” to enable ecosystem service market co-evolution

White Paper: NCU: The Commons’ Denominator: The “missing link” to enable ecosystem service market co-evolution

Building off his earlier presentation in 2022, author, farmer, academic Tim Gieseke takes readers inside the workings of the modern bushel basket, the Natural Capital Unit, to show how a modern tool that fulfills an old function can be of use for land managers, investors, and public authorities.

Ecosystem service markets do not yet function as traditional markets. Functioning markets are self-organizing with buyers, sellers and supporting actors guided by the flow on information and their economic goals. This article proposes that the difference between today’s dysfunctional ecosystem service markets and a self-organizing mature market is the NCU (natural capital unit). The NCU is the missing link, sort of a geospatial bushel basket for 21st century eco-commerce.

Whether you are involved in ecosystem service markets, sustainability, regenerative agriculture, climate mitigation, or ESG assurance, impact, or regulation the answer will eventually come down to how natural capital is being managed and how it responds. Or more simply, “what’s in your NCU?”

Join Us for a New Kind of Conversation!

Tim Gieseke and Jerry Hatfield will present the EcoCommerce/NCU Ecosystem in a live interactive session on November 3, 2022 at 11:00 a.m. US Central. The session will be hosted and moderated by Andrew Crosby of Third Horizon Earth and the Global Regeneration CoLab.

For more information and to join us, register here.New conversations: Organizations are granting themselves permission to talk about economic-based solutions. This is the energy and direction of an NCU-based EcoCommerce economic model. These are the solutions that will be trialed and applied in 2023!

What is an NCU?

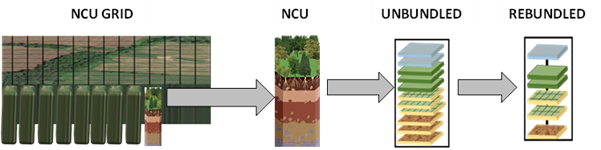

A NCU is a digitized 1m x 1m rectangular prism on a gridded landscape that contains landscape and environmental information. The NCU enables a landowner to digitize natural capital and ecosystem service layers. The landscape and management data can be unbundled and re-bundled depending on productivity goals, the demands of emerging ecosystem system markets, or ESG needs.

NCU Grid and NCUs. NCUs are 1m x 1m rectangular prisms that create the gridded landscape. NCUs are a digital representation of natural capital. Natural capital can be unbundled to assess individual layers and then re-bundled depending on which layers are of interest to the landowner or ecosystem service markets. Due to its uniform size and digital attributes, the NCU is proposed as a standardized accounting unit for ecosystem service markets and related natural resource efforts. Adapted from Shared Governance for Sustainable Working Landscapes (Gieseke, T., 2016, p 170)

Adopting the NCU as a standardized accounting unit for regulating ecosystem services such as carbon sequestration, water cleansing, pollination, etc. is analogous to the adoption of the bushel basket. The bushel basket became the standardized accounting unit for of provisional ecosystem services such as corn, oats, wheat, and apples in the 19th century, but its history goes back centuries.

The standardization of the bushel, a 1.25 cubic foot container, set up commodity markets to evolve much faster after centuries of using ad hoc measurements such as piles, wagons, carts, and buckets of grain. When the bushel basket became the common denominator for grain production, trade, and markets matured and expanded to the global scale. As a centuries-old accounting unit, it is easy to take the bushel basket for granted. But if the bushel basket was removed from the mature market structure of today, the entire global grain market would dissolve into chaos, or a new accounting unit would quickly replace it. The simple bushel basket is that important for provisional ecosystem services, and hence, the NCU could be that important for regulating ecosystem services.

Immature Ecosystem Service Markets

Markets for regulating ecosystem service are just a few decades old and are immature: price discovery is absent, bi-lateral trades are predominant, ex-ante and ex-post transaction costs remain high, governments are a primary market participant and driver, and no common or interoperable accounting or payment system has been developed.

That is not to say that during the last two decades useful market components and strategies have not been created by the hundreds of carbon, water quality, and biodiversity markets. Sellers and buyers have become more sophisticated, and scientists have created more precise environmental metrics and measurement schemes. Recently payment methods using blockchain and cryptocurrencies have made transactions more efficient. But these incremental gains have not brought any of the hundreds of markets over the elusive threshold from immature subsidized program-like markets to a mature market structure (Salzman, 2018).

The key to maturing ecosystem service markets is an NCU that contains the natural capital information in a manner that is manageable, viewable, and scalable by the market participants.

Why Create an Accounting Unit Now?

It would seem to make sense that an accounting unit would be created before the development of a market, not after it. But creating an accounting standard requires the knowledge of what the market needs to grow and mature, and that knowledge can only come from an emerging market, itself.

Presumably, the bushel basket was invented and then institutionalized thousands of years after grain was first traded. From that perspective, it makes sense that a standardized accounting system was not adopted before ecosystem service markets trades occurred. It makes sense that it took a couple of decades and hundreds of market trials to generate the knowledge of what is needed for the market.

Of course, the purposes and characteristics of an NCU are far more complex than the bushel basket. The bushel basket is a container with one void to be filled. The NCU is a geospatial database that has natural capital and ecosystem service layers that can be populated across multiple, interrelated dimensions.

Natural Capital and Ecosystem Service Layers

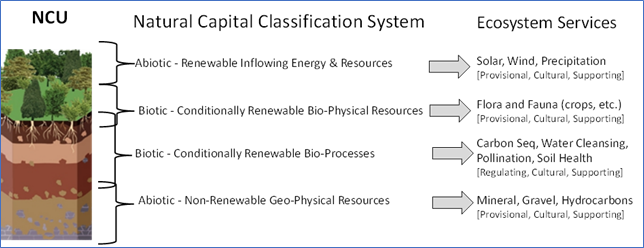

The NCU layers are described by a unique Natural Capital Classification System (NCU-NCCS) based on a system of natural resource accounts developed from an economic analysis perspective (Longva, 1981) and then applied to the NCU.

The NCU-NCCS layers are based on abiotic/biotic status; whether the capital is renewable, conditionally renewable, or non-renewable; and the source of the capital. This creates the four natural capital classifications of 1) Abiotic Renewable Inflowing Resources, 2) Biotic Conditionally Renewable Bio-Physical Resources, 3) Biotic Conditionally Renewable Bio-Processes, and 4) Abiotic Non-Renewable Geo-Physical Resources.

This approach identifies the natural capital layers that generate the suite of ecosystem services or so-called eco-units that are associated with ecological outputs and economic uses. For example, the natural capital layer of Biotic – Conditionally Renewable Bio-Processes generates regulating ecosystem services such as carbon sequestration, water cleansing, and pollination. These can be converted into eco-units that originated from a specific NCU.

NCU-based Natural Capital Classification System. The NCU-NCCS categorizes natural capital based on abiotic and biotic layers, and further describes those layers based on their renewable, conditionally renewable, and non-renewable status, and finally the source of the capital such as energy, biological systems, or physical substances. Specific types of ecosystems services are generated from each NCU layer. Adapted from A System of Natural Resource Accounts (Longva, P, 1981, p8), EcoCommerce 101 (Gieseke, T. 2011), and applied and modified for the NCU from Shared Governance for Sustainable Working Landscapes (Gieseke, T, 2016, p170).

NCU as a Common Denominator

Because the NCU-NCCS positions the NCU at the nexus of both economic and ecological systems, the NCU is an ideal candidate to be the common denominator for natural capital and ecosystem service accounting. A major role of the NCU is to incorporate the intangible assets of regulating ecosystem services into transactions and markets with relative efficiency.

Making intangible assets tangible often requires a new accounting unit. A major reason intangible assets are intangible is because an accounting unit for that type of asset does not yet exist.

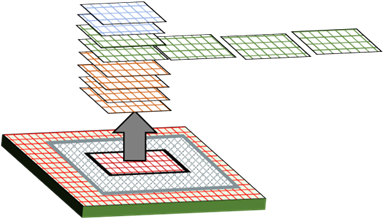

On a digitized platform the NCU can make intangible or less tangible natural capital components and ecosystem service assets more tangible through a process of vertical and horizontal accounting.

By creating natural capital layers based on the NCU-NCCS, a land manager can assess individual layers of natural capital while managing the layers from an integrated vertical perspective

Digitization of NCU for Vertical and Horizontal Accounting. A digitized NCU grid can identify natural capital layers and the individual ecosystem services. Vertical accounting recognizes the interrelated connections between layers from a management perspective.

Horizontal accounting recognizes and accounts for a single ecosystem service layer in a horizontal manner. Managers view the landscape from a vertical perspective and external partners or markets view the landscape from a horizontal perspective. Management activities and environmental factors may affect one or more vertical layers simultaneously causing environmental and productivity loses and gains that can often be overlooked without this dual accounting system. Adapted from NCU platform from Shared Governance for Sustainable Working Landscapes (Gieseke, T, 2016, p227)

Vertical accounting is important, because any land management activity or environmental factor has the potential to impact one or more of the natural capital layers, and hence, may impact one or more of the ecosystem services generated by each natural capital layer. These changes happen simultaneously and to different degrees. Vertical accounting is important to the land manager as their goal is to optimize the entire stack of natural capital for productivity and system health.

Horizontal accounting focuses on eco-units or a single ecosystem service in a layer to supply a market demand or government programs. A value of horizontal accounting on a NCU platform is so the location of the ecosystem service sold is known and that the ecosystem service is only sold to the proper buyer(s). The former would benefit clients concerned with greenwashing, and the latter would provide assurance that double-selling could not occur.

Vertical and horizontal accounting may sound a bit overwhelming, but a landowner can choose to engage with just a single issue and layer, such as a carbon market and then build out their eco-portfolio as they deem appropriate or as ecosystem service markets grow and mature.

As a common denominator of accounting, the NCU data also supports productivity objectives from ecological and economic perspectives, which remains a primary objective for land managers.

The result is a vertical and horizontal accounting system with the capacity to account for natural capital layers (vertical management) with each layer having the capacity to generate a limited, but potentially extensive list of ecosystem services (horizontal markets) having ecological functions and/or economic uses.

Digitizing the NCU to Create Excludable Environmental Goods

The combination of NCUs, cryptography, and distributed ledger technologies (DLT) or blockchain can do what traditional economists have long deemed impossible – to have functioning markets for environmental (common or public) goods.

The implications of such a shift are profound, as this could capture positive and negative externalities and incorporate them into the economic system. The inability of the economic system to account for externalities is the crux of the “tragedy of the commons”, and so converting externalized common and public goods into internalized private and club goods could be considered the holy grail of resolving environmental issues.

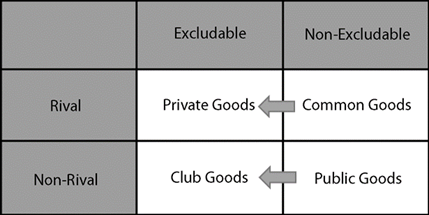

Unbeknown to most, goods and services are not categorized as public and common by their inherent qualities, but by society’s institutional and technological capacity to create or not create excludability and rivalry of the good. In other words, if institutions or technology can reduce or prevent free-ridership (use without paying) then a good that is traditionally defined as a common or public good can be recategorized as a private or club good (McNutt, P., Public goods and club goods, 1999).

Unbeknown to most, goods and services are not categorized as public and common by their inherent qualities, but by society’s institutional and technological capacity to create or not create excludability and rivalry of the good. In other words, if institutions or technology can reduce or prevent free-ridership (use without paying) then a good that is traditionally defined as a common or public good can be recategorized as a private or club good (McNutt, P., Public goods and club goods, 1999).

Economic goods are categorized relative to their excludable and rival status, rather than by their inherent qualities. Goods deemed non-excludable do not have ownership characteristics and markets do not spontaneously develop. If a common or public good can be made excludable, it will be recategorized as a private and club good, respectively. Adapted from graphic and concepts described in Shared Governance for Sustainable Working Landscapes (Gieseke, T., 2016. P 171)

Since NCU management and eco-unit data is proprietary and blockchain has the capacity to exclude NCU data, then NCU data needed to substantiate sustainability claims or represent ecosystem service credits becomes a private good or club good.

Private goods are excludable and rival. Club goods are also excludable, but non-rival, meaning a limited number of entities can use the good simultaneously or over time. A toll road or community park is an example of a club good that can be used by multiple, but limited number of people.

A case where an ecosystem service became an exclusive and non-rival club good occurred during the Minnesota Department of Agriculture’s Livestock Environmental Quality Assurance (LEQA) program (Gieseke, T, 2011). The LEQA was designed as a water quality assurance program where the MDA required farmers to maintain a certain value of a water quality index (WQI) to ensure their operation was in compliance with the state’s “reasonable assurance” criteria. During the project period a cheese processor that procured milk from several of the farmers inquired about gaining access to the WQI data to support and substantiate their sustainability objectives. A utility power company that was evaluating the use of corn stover to make cellulosic ethanol also inquired about the use of the WQI and other sustainability metrics that would support and substantiate their sustainability objectives. In each case, NCU data would be used by different entities for similar, but different purposes. The farmers had the ability to restrict or allow access to the data depending on the use. Due to the different uses, the data would remain non-rival between these entities.

If the NCU data was only sold as a (exclusive and rival) private good, then only one entity would obtain the data they needed to achieve or account for their sustainability objectives. Allowing the NCU data to function as a club good is a better representation on how ecosystem services are used by people, entities, markets, and the economy.

Today’s immature ecosystem service markets do not have the sophistication to manage ecosystem services as club goods, and so, all the costs associated with an ecosystem service falls on one entity as the sole purchaser of the private good. The results in the market begin unable to create shared value and to provide ecological data to the entities that require it to meet their sustainability needs.

The use of club good status is not a case of double-selling in ecosystem service markets, in the same manner that club goods are not a case of double-selling in any market. In the case of club goods, the value of the NCU data is not sold multiple times, but the value of the NCU is shared among multiple entities. This is the market model that illustrates Porter’s (2011) shared value concept and is aligned with shared governance principles that enable partnerships, ownership, equity, and accountability to occur at the point of service (Gieseke, 2019). In the NCU market model, landowners delineate a grouping of NCUs to generate a GeoNFT, which becomes the point of service on the NCU platform where convergence and shared value occurs.

Digitizing the NCU and Platform to make it ‘Real’

The physicality of a bushel of grain makes it a private good, and its physicality also makes measuring, valuing, and transacting it real. It is the physicality that brings people together to negotiate and trade. Regulating ecosystem services lack this physicality that makes traditional markets spontaneously emerge and mature.

To create these traditional market forces, the NCUs are made tangible or real through Web 3.0, cryptography, blockchain, and multi-sided platform technologies. Landowners can delineate NCUs into the shapes of the fields and parcels they manage. The NCU platform converts these management polygons into GeoNFTs that become part of their natural capital and ecosystem service portfolios. NFTs or non-fungible tokens became widely known recently as tradable cryptocurrency-like units in art and other collectables. In this case, the GeoNFT enables a landowner to secure ownership of their landscape data as well as give others access to the data to the extent they deem acceptable. The GeoNFTs contain the NCU data associated with vertical and horizontal accounting. For example, the GeoNFT would enable a landowner to share data associated with a carbon market to one entity, water quality data with another entity, and perhaps the entire natural capital data stack to their production and marketing consultant. Landowners would apply metrics and other algorithms to each GeoNFT to calculate outputs which could be included in a landowner’s eco-portfolio and shared to the extent the landowner desires.

Landowners could use these GeoNFTs and metrics to seek out markets and find external partners that have common interests in location and ecosystem service parameters. This GeoNFT accounting package essentially becomes a landscape-partner matchmaking function where two or more parties can locate each other based on landscape criteria they develop. Imagine two or more parties from any part of the world connecting with each other based on any common landscape interests and outcomes. This feature greatly reduces ex-ante costs associated with connecting buyers and sellers or connecting landowners with government or corporate programs.

Co-evolution of the EcoCommerce Ecosystem

A business ecosystem can emerge and become self-organizing when stakeholders can freely interact to achieve their objectives with properly designed components. The EcoCommerce® ecosystem can emerge from the NCU-gridded platform by creating private and club eco-unit goods associated with the NCUs.

Moore (1993) states that private and club goods create the market forces of competition and cooperation, but even more important for ecosystems development is co-evolution of the market.

A key to co-evolution of markets is the ability to give stakeholders a stable foundation and a flexible and innovating interface. In EcoCommerce, the stable foundation is the NCU platform, and the flexible interface is ecosystem service metrics and measurement technologies.

Thus, the NCU is the stable, site-specific container that can contain metrics specifically designed to meet landowner, buyer, and market needs. As technology, science, and socio-economics evolve (and they most certainly will) today’s metrics will be replaced by innovative new metrics, but all the data remains in a stable geospatial location. Perhaps equally important is that as land use evolves from natural, to agriculture, to residential, to municipality, to industrial and perhaps back again, the NCU remains stationary while the ecosystem service outputs may drastically change. As natural capital is recognized as a vital environmental, social, and economic value, the NCU can track the ecological benefits and liabilities throughout time and ownership.

One of the more promising aspects of an EcoCommerce ecosystem is to have partners create and contribute innovative metric and measurement apps. The metrics that have the right mix of precision, accuracy, cost, and useability should gain favor in the ecosystem market. Land managers and ecosystem service buyers could choose from a cache of metrics that best represent their needs, and in a crypto-economic model, the developers could be compensated with tokens when their app is used. While there are many new opportunities provided by the NCU Platform, the opportunity to apply and evaluate a myriad of ecosystem service metrics may serve the immediate innovation need in the measurement, verification, and reporting aspects.

Many eco-markets are stuck in analysis paralysis as they wait for the unattainable, perfect metric to be created. To jump start or even initiate markets, the buyer may choose a metric with the intention to upgrading it as new innovations or science occurs. All the NCU data could remain the same and the metric could be replaced with new eco-units generated. Enabling partners to demonstrate their MVR models and be compensated for their innovation may be the key to accelerating evolution toward a more mature ecosystem service market status. This is type of innovation space cannot be produced outside a business ecosystem environment.

Next Steps toward the EcoCommerce Ecosystem: A Margaret Mead Strategy

Solutions to society’s greatest issues will probably not come from the most powerful governments, most profitable corporations, or the largest NGOs, but from, as Margaret Mead explained, “Never doubt that a small group of thoughtful committed citizens can change the world; indeed, it’s the only thing that ever has.”

If Margaret Mead is correct, then it would be prudent to heed her advice and move forward with a small group of thoughtful committed citizens – especially if it’s the only thing that has ever worked!

In August 2022, Global Regenerative CoLab hosted a small group of thoughtful committed citizens to engage in an EcoCommerce and the NCU presentation. This led Sid Embree, Jaguar Legacy Fund, to host another group of thoughtful committed citizens for the same presentation. Since then, there has been several conversations about how to collaborate on pilot projects and to reconvene and further explore the costs and advantages of the EcoCommerce/NCU accounting platform.

The next step is to lay out a strategy that a small group of thoughtful committed citizens can discuss funding, governance, pilot projects, and ownership models of an EcoCommerce/NCU platform.

What do EcoCommerce MVP Pilots look like?

Depending on the extent of the minimum viable platform (MVP) the pilot markets would be in different of geographies and address different issues related to natural capital, ecosystem service markets, supply chains, and ESG-related goals. In each case the landowner or manager would delineate the NCUs to create GeoNFTs to begin the process to account for and assess the natural capital layers of the NCU, and potentially offer ecosystem service credits or management data for sale.

For a buyer, they would delineate their area of interest by drawing a polygon on the NCU platform and denote what ecosystem service is of interest to them. If area and parameter(s) of interest overlap or are in common with a seller, then the platform will “notify” the seller. Seller and buyer can interact, and exchange information related to the ecosystem services of interest and chose the MVR requirements based on a depository of metrics or use their own.

If the buyer and seller agree to the area and metric, and negotiate a trade, then a token connected to the platform stablecoin (cryptocurrency) would be exchanged. Each market type (e.g., carbon, biodiversity, water quality) would have their own specific token which each token exchangeable with the platform stablecoin (e.g., USDC). If a third party has a role in the transaction, they too could also be compensated with EcoCommerce market tokens.

When the transaction is completed, there will be a geospatial and temporal record tied to the GeoNFT that contains the NCUs of interest. Transactions can occur on the timescale that makes the most sense for the buyers and sellers such as daily, monthly, seasonally, yearly, etc. In regulating ecosystem services that are generated by farming activities, yearly transactions would be aligned with management activities.

Pilot Market Examples

Depending on the extent of the MVP, different use case scenarios can be entertained. Since everyone depends on natural capital and ecosystem service, the list of possible uses is nearly endless and could include any of the following examples or versions of them.

- A Seattle citizens group informing the city council on how to incorporate the $3B a year in benefits and savings that the city’s natural capital provides

- A Japanese regenerative agriculture community enabling people to account for cultural ecosystem services and provide a way for the community to invest into the culture to preserve it

- A Peruvian effort that invests in a natural capital management model for forest and agroforest landscape restoration of large, degraded areas

- A Northwest USA company supporting a new grain economy by developing regenerative agriculture-driven supply chains

- A carbon market keenly interested the most transparent way for agricultural producers to account for carbon removal and emission.

- A life-cycle analysis of an agriculture commodity that begins at a GeoNFT and is tracked though the supply chain

- A biodiversity effort to invest in mature and emerging conservation markets to protect and restore biological corridors and biodiversity throughout Latin America

- The use of GeoNFT to inform ESG assurance, impact, or regulation objective to give context of ESG parameters that are rooted in natural capital

- An ecosystem-wide analysis of the natural capital capacity of the Great Salt Lake watershed and strategies to account for and incorporate economic and ecological values in the local economy and state policies

In many of these projects, there are billions of dollars of natural capital wealth and functions that are unaccounted for. Globally, there is an estimated $54T of unaccounted natural capital wealth in a global economy of $100T. The percentage of ecological contribution to the economy is so large that it doesn’t seem to be real – how could humanity reach this point in its history without accounting for the natural capital that brought us here? That question is easy to answer. The harder question is how we get to where we want to go without accounting for it.

It should not be difficult to accept this scenario and our potential predicament. It may be a bit difficult for established institutions adopt a natural capital accounting system as change is difficult. But this type of change is emergent and scalable. And yes, the NCU platform and the EcoCommerce ecosystem is sophisticated, not simple, but it is simple enough to begin the process to incorporate an ecological dimension into the economy one pilot project at a time, for starters.

Call to Action

“Infinite patience brings immediate results” comes to mind as this journey of two decades reaches another milestone. In the last six months the NCU and its attributes have come into clearer focus. The technologies that will enable the NCU platform to support the necessary market forces are now developed. The collective will and knowledge from many people, organizations, and governments are at a critical mass. Information and communication technologies enable people to create crypto-economic systems to resolve society’s wicked issues using shared governance – a scenario that was impossible for governments to solve just a few years ago.

The call to action is to design and employ an NCU-based platform to enable an EcoCommerce Ecosystem to emerge. This will take a relatively small group of thoughtful committed citizens that are part of or have access to natural capital and ecosystem services projects and markets.

The NCU logic and components that are described in this article need to be laid out in a business ecosystem with detailed analysis of participants and pathways. There are a handful of organizations that are well-suited to carry out this work. This ecosystem design work will be done in coordination with those involved in ecosystem service markets, life cycle analysis, natural capital projects, and sustainable supply chains. Once the ecosystem is understood, designers in the Web 3.0, blockchain, and cryptography community will code and digitize the structure, processes, and functions of the EcoCommerce ecosystem.

If you want to be part of the design, funding, developing, application, and use of the NCU platform please contact myself, Tim Gieseke at tim@agrsllc.com

About the author

Tim Gieseke had careers in government, non-profit, and the private sector with each encompassing the space between economic and ecological aspects of land management. He is also a farmer and the first-noted ecocommercist. He authored a trilogy of books; EcoCommerce 101 (2011), Shared Governance for Sustainable Working Landscapes (2016), and Collaborative Environmental Governance Frameworks (2019) that describe the environmental, social, and governance aspects of initiating an EcoCommerce Ecosystem.